|

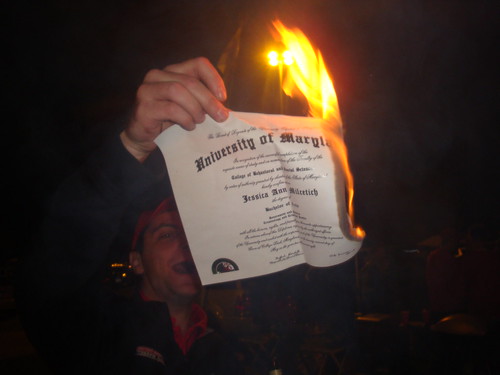

| Diploma burning has replaced flag burning as the youths protest of choice |

Meeting with an old friend I hadn’t seen in a while when I

heard some interesting news. He had recently changed jobs, which in of itself

isn’t an item worthy enough to blog about, however, what his new job was is

interesting. You see my friend recently

was employed at a major bank/investment firm to do investment work, once again

nothing too interesting, and he doesn’t have a degree in math, finance, or

accounting. He has a degree in criminal

justice, originally wanted to be a cop and probably would have been a good one

too, and a master’s in public administration, he worked for local government for

a little while but arguing down his boss from spending $2,000 on garbage receptacles

grew tiresome. This is interesting

because as someone with a finance degree I had no illusions that my chance of

even obtaining an interview, much less being hired, at any one of those big

companies was next to nil. How he get

his job would give the Captain an aneurysm but considering that I know him to

be a very capable individual it illustrates something. Most business degrees are not worth your time

or effort.

The fact that I, as someone who focused on finance, couldn’t

even get my foot in the door as a bank teller when I first left college, and

that someone with no mathematical experience whatsoever could work for a firm,

illustrates this fact all too clearly.

And this isn’t to chastise or wave my finger at my friend for using

connections to get a job, that would be hypocritical since after almost two years of

unemployment I was forced to do the same thing for my previous job, it’s to

illustrate an important reality that all too few college kids think about. Who you know is extremely important, more so

than what you know. The other is that your business degree isn’t worth the paper it’s

printed on.

Plenty of articles have cropped up about how it is difficult

to find work if you have a liberal arts or some other soft degree relative to a

hard knowledge degree; however, people fail to realize, that outside of

accounting, business is just as nebulous as a liberal arts degree. Now some of you might say I am leaving out

economics, I intentionally did not lump it with accounting, and finance. With finance, while it may have one point

been a good degree to get, it’s the simple fact that:

a)

There are far too many of them. It was easily

the most popular business degree at my university and perhaps the most popular

degree outside of liberal arts.

b)

Outside of highly leveraged investing they don’t

teach you anything that you couldn’t learn on the job in a couple of weeks.

Though as my grandma would say, the proof is in the pudding,

and while I could try to drum up some sort of statistics I am going to allow

myself the liberty of anecdotal evidence.

The three things I noticed with finance degrees are that

1)

After failing to land a real analyst job they

end up becoming, or continuing, to be a teller a bank

2)

Go back to get an MBA

3)

End up working in ‘investments’, and by

investment I mean they become a salesperson with title like ‘investment

coordinator’, ‘client accounts representative’, ‘personal banking broker’ or some other ludicrously long name for a

salesman.

Now there’s nothing wrong with sales. But sales jobs do not need a degree, and I

highly doubt that people getting a finance job want to end up in sales. They simply end up in those jobs because they

are the only ones that will accept their applications after college, believe me

I know as I sent out hundreds of applications and only one that I got a

response back was for an actual analyst job while the rest were sales of some

sort. If you are like my brother who is the

greatest bull shitter and networking I know, he somehow leveraged a 6 month ‘job’

in Germany from someone he me with and corresponded with over email a few times,

then this kind of job is great. However,

if you’re more introverted or analytically minded then these jobs are nothing

sort of a sentence to a living hell. But

mark my words, if you major in finance, then you will most likely end up in

sales.

The other reason it is hard to get a good analytical job is

simply that a college degree just doesn’t mean anything because anyone who isn’t

functionally retarded, or simply lazy, can get one if given enough time. Have you noticed how it is taking more and

more individuals longer

than four years to get a degree? Part

of it is the ever increasing requirements to take worthless classes such as

basket weaving, or that it is simply harder to get the classes that one needs.

But the other aspect is that you have more people going to college who simply

are not up to the challenge, at least at that point in their life but colleges

will not flunk all but the most slothful of students.

If you don’t believe me then try and recall how many of your

friends who attended college washed out?

Remember the stereotypical dull professor saying ‘look to your left; now

look to your right. One of them will not be here in four years’? The idea was

the college was so difficult that there were individuals who simply could not

handle the load. No longer, remember

colleges are businesses, as now the university system will hand hold you the

entire way through. If you have a

finance degree and don’t have anything better than a 3.7 GPA then expect to have

a more difficult time finding good financial work. You could have a 3.2 GPA but because of grade

inflation and hand holding you might as well have a 2.5 GPA because of it. I routinely

applied for jobs that stated that any resume with a GPA less than a 3.5 wouldn’t

even be looked at, regardless of work experience.

The other aspect not thought about is what university you

went too. You could have graduated magna

cum laude and been the valedictorian of your class, but if it was in a

university that no one outside of you state would know about, then you will

struggle mightily outside of that area. If you want to work in Wall Street you

better hope you went to somewhere like Harvard, Yale, and NYU or else you are

going to be sorely disappointed. The pedigree

of your degree matters, regardless of whether or not the pedigree that academic

institution have is still actually warranted. I am of the personal opinion that

most schools are pretty equivalent to each other when it comes to teaching hard

sciences and mathematics, but sadly my opinion doesn’t rule the day.

What this means is that if you want to get that investment

job you either need to go to a really prestigious school, at least for your

neck of the woods, and work your ass off. Or you need to network like

crazy. Because it doesn’t matter if your

bright or highly competent. Outside of

being a wunderkind, that isn’t enough. It matters far more who you know or

where you went. Because if you know the

right person, aren’t a moron, and interview well then it doesn’t matter what

degree you get.

I won’t lie, I was a bit jealous when I heard the news.

Though knowing him I am sure he will do very well and excel in his new job. And

to be honest, knowing what I know now I am actually worried for him. A lot of people are employed in a sector that

is going to be hurt very badly when the boomers start retiring and they will

have a hard time finding the same kind of lucrative jobs once the financial

sector goes through a much needed generational correction. He’s got a family and kids to look after, one

of my few millennial friends who are married with kids by the way, and he needs

a well paying job far more than I.

As someone with a finance degree, I couldn't agree more.

ReplyDeleteI figure I've been getting contact from about one in every eighty reumes I send out. And that from jobs at sporting goods stores, grocery stores, Lowe's, etc. And also despite my relatively high iq and, I think, good work history, with nothing but good references from my previous employers.

This comment has been removed by the author.

ReplyDeleteJobs, degrees, entreprenorship.

ReplyDeleteThere is a last option that is never discussed which also involves risk taking and could provide great rewards ... WAR

I will only be happy on the battlefield, not in the HR's office.

Thank you

ReplyDelete