Girlfriend forwarded me an article from the New York Times on Abenomics and asked what I thought of it. I replied by forwarding a video posted on After the West that covers one of the major problems with Abenomics. Abenomics is essentially a three pronged approach towards jump starting Japans stagnant economy.

The first prong, massive government investment, is nothing new for the Japanese. Every Prime Minister of Japan since the early to mid 1990s as tried government investment to little effect. There is little reason to think that Abe's economic stimulus is faring any better.

The second prong, economic deregulation, is the only one that will actually benefit the Japanese economy in the long term. While we, at least publicly, worry about the growing incestuous relationship between governments and corporations; corporate cronyism is a matter of course for the Japanese. Though deregulation doesn't directly address corporate cronyism, it helps remove barriers that corporations use to keep more efficient companies from taking market share. If Japan wishes to compete in an increasingly competitive world freer markets are a must.

The last prong of Abenomis is probably most responsible for the 'boom' that Japan is currently experiencing, however, it is the one most likely to wreck utter destruction on the Japanese in the long term. The government of Abe is flushing the Japanese economy with crash in efforts to raise the inflation rate, and more importantly, decrease the value of the Japanese Yen.

Japan is very tied into the global economy. They export over $ 788 billion worth of goods and import over $ 808 billion of goods, giving it a TAPG ratio of 98%. Japan's trade deficit is a rather recent development and even during the height of the lost decade Japan maintained positive trade balances. But Japan is utterly dependent on outside sources for energy, over 20% of their imports is energy related, and doesn't possess a lot of internal recourse like the United States. Japan has to purchase foreign energy sources and the rise of energy prices, coupled with the shuttering of nuclear power plants, only exacerbates their situation. In an environment with a weakening Dollar and Euro, they see currency depreciation as one of the only ways to compete currently.

At the moment Abenomics appears to be working but a drug addict suffering from withdrawal will also appear to benefit from a little bit of the drug they were addicted too to help ease the symptoms. It's a terribly short term solution for a very long term problem; the kind of solution that politicians love. Ultimately Abenomics will only hasten the inevitable default that will absolutely happen to the Japanese. My advice to the Japanese is to enjoy the ride before the roller coaster comes of the rails. Japan is beyond saving at this point. Saikō no kōun

A blog on the intertwining of History, Culture, Geopolitics and Economics from a millennial.

Tuesday, May 21, 2013

3 comments:

Disagreements and countervailing views are welcome, however, comments will be deleted if:

-They have emoticons.

-If it is obvious that you have not read the post.

-Obvious Spam, and it takes me about a quarter second to determine if it is spam since you all write your comments the same way.

Subscribe to:

Post Comments (Atom)

About Me

- Cogitans Iuvenis

- Seattle resident whose real name is Kevin Daniels. This blog covers the following topics, libertarian philosophy, realpolitik, western culture, history and the pursuit of truth from the perspective of a libertarian traditionalist.

I couldn't agree more. I think Japan is hoping that by inflating their currency, they will be able to lower prices and export more, but this is during a time of complete global slowdown in retail demand. They also seem to be pissing off their major trading partners with regional disputes. Absolute insanity.

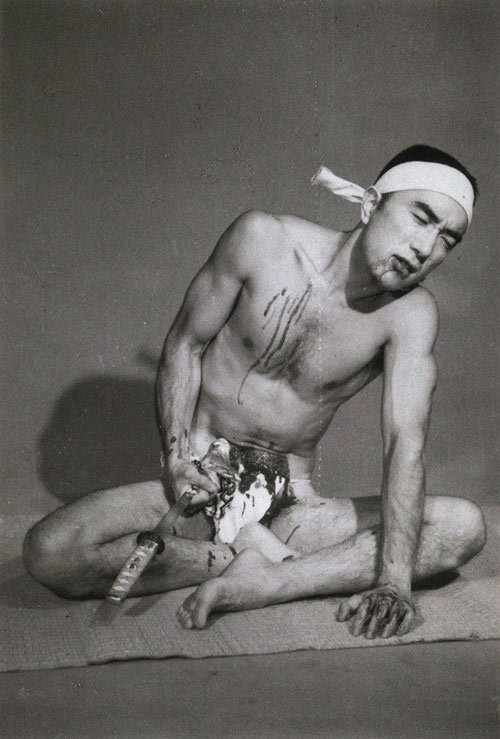

ReplyDeleteDuring Bass's video, he mentioned that a former finance minister in Japan committed suicide, and another checked themselves into a hospital for anxiety. That doesn't sound like the kind of behavior for someone who is proud of their role.

I still think Europe goes boom first, because Japan's saving grace is how their debt is mostly held internally. I didn't know they were going the deregulation route. Thanks for sharing.

ReplyDeleteI see their internal debt as a mixed bag. On one hand, they're less vulnerable to foreign bondholders selling their JGBs, but they're also more likely to restructure or default on their own citizens. Either way, I don't see it inspiring confidence in the Japanese economy with the rest of the world.

ReplyDeleteYou make a good point about Europe. Their banking sector is way, way over-leveraged and completely and utterly insolvent. Miles of red tape and confiscation of deposits don't inspire new business investment either.