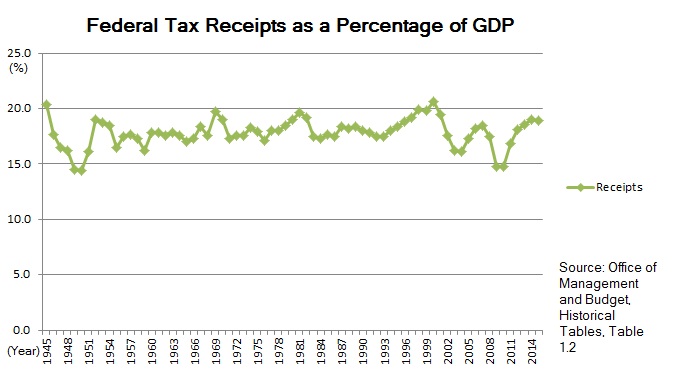

This is a chart I did not make myself, rather I pulled it from an MSN article that was trying to make a case saying that the American tax payer has had it easy for a long time. The author simply cannot, or just will not, see that we have a spending problem. Though I will be fair and give the author credit for admitted that Al Gore also promised to cut taxes, however, when both candidates of two different parties are promising to do essentially the same thing, only differing in the matter of degree, is that not indicative of something larger?*

Moreover, the author is missing something entirely. He can believe that the American tax payer has had it easy, receiving more 'benefits' from the government than what they have been willing to pay, but that is ignoring that at one point marginal tax rates on the rich were far higher than they are now. This chart does not go back that far stopping at 1990 because by going back any farther it would disapprove the authors attempted point, that we need to raise taxes in order to goose government revenue. Here is the chart the author should have posted if he were to be intellectually honest.

It should be no wonder then that tax revenue has fallen recently, and it should be equally clear that raising marginal rates will make no difference on how much revenue we receive. The rich are people like everyone else, save that they have more options available to them, and if they think they are getting fleeced then they will hall up and move. This has long been a tenant of free market theory, and has been proven empirically, just look at Great Britain.

It is then, with this new knowledge and awareness, that we see by looking at the original chart posted by the MSN author, that it clearly shows a spending problem. Never in our 60 year history has tax revenue ever exceeded 20% of GDP, regardless of marginal tax rates, yet spending has consistently exceeded this mark. . If real world empirical evidence shows this, and it does, then only a wilfully foolish individual would contend the opposite. But that is how propaganda works, contend that something is right and true whether or not reality reflects this. The Soviets were able to do so for over 70 years, but in the end Communism was shown to be the broken house that it was. It will not be too much longer until democratic socialism is shown to be just as broken.

Finally, this is what angers me most, is that whether or not you believe the rich should pay more of their income in taxes, you should still be tempered by reality, and not the reality of one's own choosing but as it actually exists. And reality here clearly shows that we will not receive more than 20% of our revenue in GDP, we have 60 years of data to back up this statement. Barring any fundamental change towards Americans attitudes towards paying taxes this will not change. So any effort to try and do so is a waste of time and resources that would be better spent elsewhere. Imagine all the brain, monetary, and legal power that is wasted towards pursuing an end that cannot be achieved, and what would happen, if it instead, all that energy was directed towards more more attainable and productive ends.

*Lastly, without going into my rant on how the surplus never really existed, the first chart should point out something all too clear. That the surplus was temporary, and that if we were to maintain an actual surplus then spending has to remain below the 50 year trend line.

The system truly is broken and those who are supposed to fix it offer the latest witches brew as a solution.

ReplyDeleteArithmetic shows that even if all discretionary spending was cut we'd still have an annual deficit.

On the one hand they suggest that defense spending is to high, as they now want to cut service members pay and benefits. Never mind that the cuts amount to nothing over 10 years.

But on the other hand they say we need to spend more money to stimulate the economy.

It's a fools game.

I did think to myself yesterday, that when the retraction comes, it's going to come hard and boy oh boy is gonna hurt.

Yes, its something that many progressives never consider. Much of discretionary spending is military, which is where they come up with that 50% of our budget is on defense and a great example of using facts to create lies.

DeleteI agree with you on the retraction, and pardon my pun, its going to hit us like Thor's hammer.